Payroll taxes are aggressively pursued by the IRS & State authorities and put many good companies out of business.

When sales are down, it can be extremely difficult—if not impossible—to pay the payroll taxes you owe. It’s not uncommon for business owners and self-employed persons to put other bills and liabilities ahead of tax payments just to keep the lights on. When this happens, one or two missed quarterly tax payments can easily spiral into a year or two of back taxes. Other errors such as filing mistakes, forgetting to mail a single form, or overlooking a single line on one form can draw the ire of the IRS and result in penalties and compounding interest.

We’ve seen it all, and this is for certain: one year of unfiled taxes tends to swell into several, even for the most well-intentioned taxpayers.

It’s not uncommon for taxpayers to avoid filing tax returns because they know they’ll owe more than they can afford to pay. In other cases, missing records, divorce, death of a spouse, death of their tax preparer, or serious illness can lead to failure to file. Others aren’t sure if (or how) they should report certain income, so they don’t file at all. Still, other folks don’t file for political reasons.

We can advise you on the best course of action and assist you in amending any tax returns or making arrangements for any outstanding balances due.

1) helping you decide whether to file Married Filing Joint or Married Filing Separate,

2) completing all missing tax returns

3) knowing what the best resolution is before filing any returns.

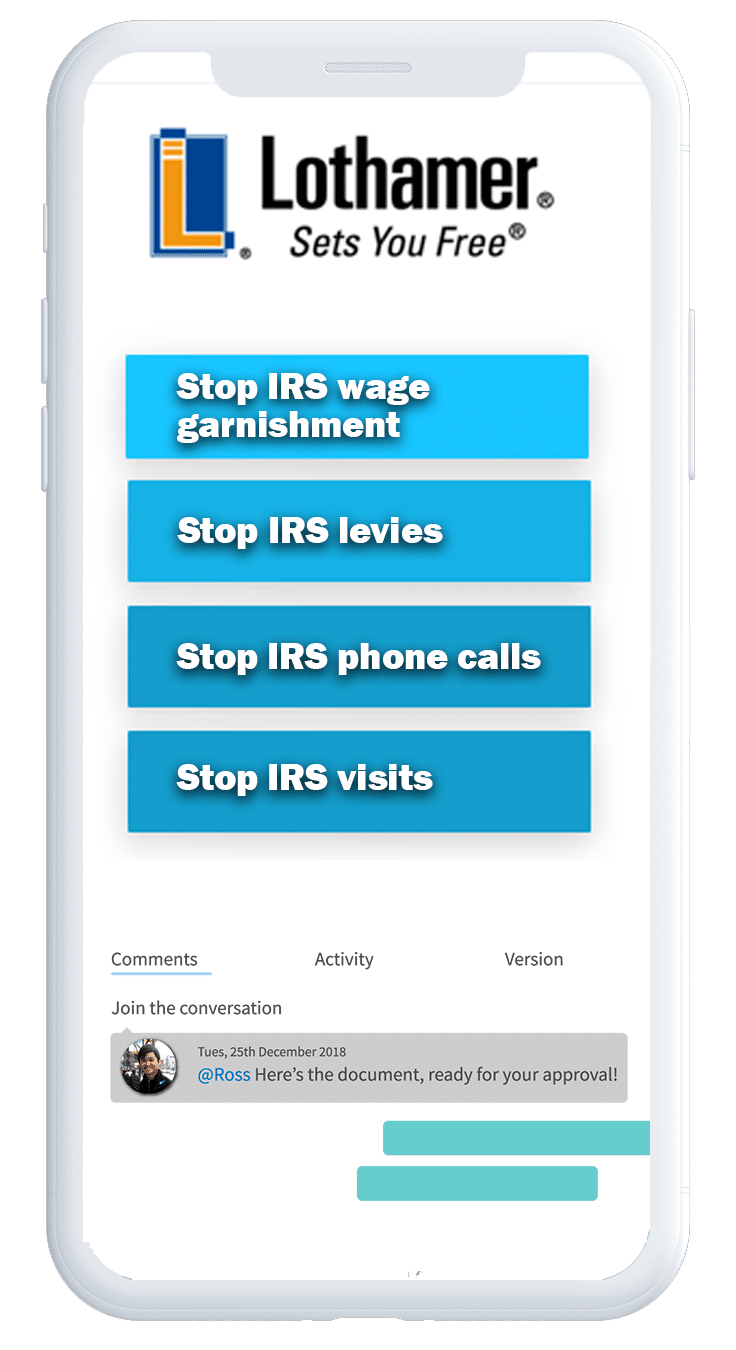

Unfreeze Your Bank Account & Take Back Your Financial Freedom from the IRS. Let Us Fight For a Levy Release and To Help You Keep Your Full Paycheck.

If you have received notice that your accounts have been levied, it is imperative that you take immediate action as the bank will set aside the funds in your account for only 21 days before remitting them to the IRS.

If paying ANY money towards your taxes would create an undue economic hardship, we can negotiate with the IRS to stop collection actions against you for a period of time until you are in a position for permanent resolution.

It Is Possible to Stop All Collection Action By Receiving IRS Non-Collectible Status.

IRS Currently Non-Collectible (CNC) Status is intended to help those in a position of financial hardship, but who are unable to do an Offer in Compromise, Bankruptcy, or an Installment Agreement.

The ability to receive Non-Collectible Status is strictly determined by an evaluation of your financial situation. If you simply cannot borrow against assets, nor afford an installment agreement, it may be possible to get the IRS to put your account in a Currently Non-Collectible (CNC) Status, or give you a partial payment plan. However, Currently Non-Collectable status is only a temporary solution with the IRS, possibly only lasting a minimum of one year. If you are placed into Non-Collectible status, you will still need permanent resolution such as an Installment Agreement, Offer in Compromise, or in some cases Bankruptcy. Many times an uncollectable status can be used as an interim step to prepare for doing an Offer in Compromise, or to buy time to file bankruptcy, or simply to let the Statute of Limitations expire.

Establishing installment agreements with the IRS is no simple task. Let us prepare and negotiate a payment plan you can live with.

If you find yourself unable to pay your back tax liabilities in full and up front, you may be able to get an Installment Agreement to pay back the balance over time. We negotiate State & IRS Installment Agreement requests on your behalf to get you the most favorable result possible.

There are several types of IRS Installment Agreements depending on how much you owe and your collectibility status.

We analyze your collectibility based on financial information you provide and will negotiate an Installment Agreement based upon your ability to make monthly payments. We will also analyze whether you qualify for an Offer in Compromise (OIC), which is a reduction in the amount required to be paid, or some other form of resolution that would provide resolution to your tax problem.

If paying off your back tax debt seems impossible, you may be eligible for the IRS Fresh Start Initiative.

With the Fresh Start Program, the IRS has introduced a more real-world approach to providing relief for struggling taxpayers. The Fresh Start Program includes the following

● Expanded streamline installment agreement for individuals owing over $25,000 in tax debt to the IRS.

● Allowing for the withdrawal of a Federal Tax Lien if the tax debt is paid through a Direct Debit Installment Agreement, and the tax balance is under $25,000.

● Businesses that owe $25,000 or less in payroll taxes and have filed all required returns may obtain an installment agreement without having to supply the IRS with financial information.

Some taxpayers may be eligible for an Offer in Compromise (OIC.) An OIC is an agreement between the IRS and a taxpayer to settle the taxpayer’s liabilities for less than the full amount. The IRS Fresh Start Program made changes to the Offer in Compromise as follows:

● Expanded the streamlined Offer in Compromise program to cover more taxpayers.

Revised how the OIC is calculated.

● Allows the taxpayer to use expenses that previously the taxpayer could not claim as a reasonable and necessary living expense.

● Allows the taxpayer to exclude income-producing assets in calculating the amount of an Offer in Compromise.

Negotiating & Procuring Offer In Compromise (OIC) Deals That Can Dramatically Reduce The Amount You Owe. We Handle Everything.

You’ve seen and heard TV and radio personalities promising “pennies on the dollar” and wondered if they were legitimate.

There are proven and effective ways to substantially reduce your tax liability, and there is no question that you should pursue them if you qualify. Offer in Compromise (OIC) programs allow you to pay the IRS, and in some states like Michigan, a lump sum to settle your tax burden. Upon acceptance and payment of your Offer, all applicable tax liens are removed, and you can move on with your life.

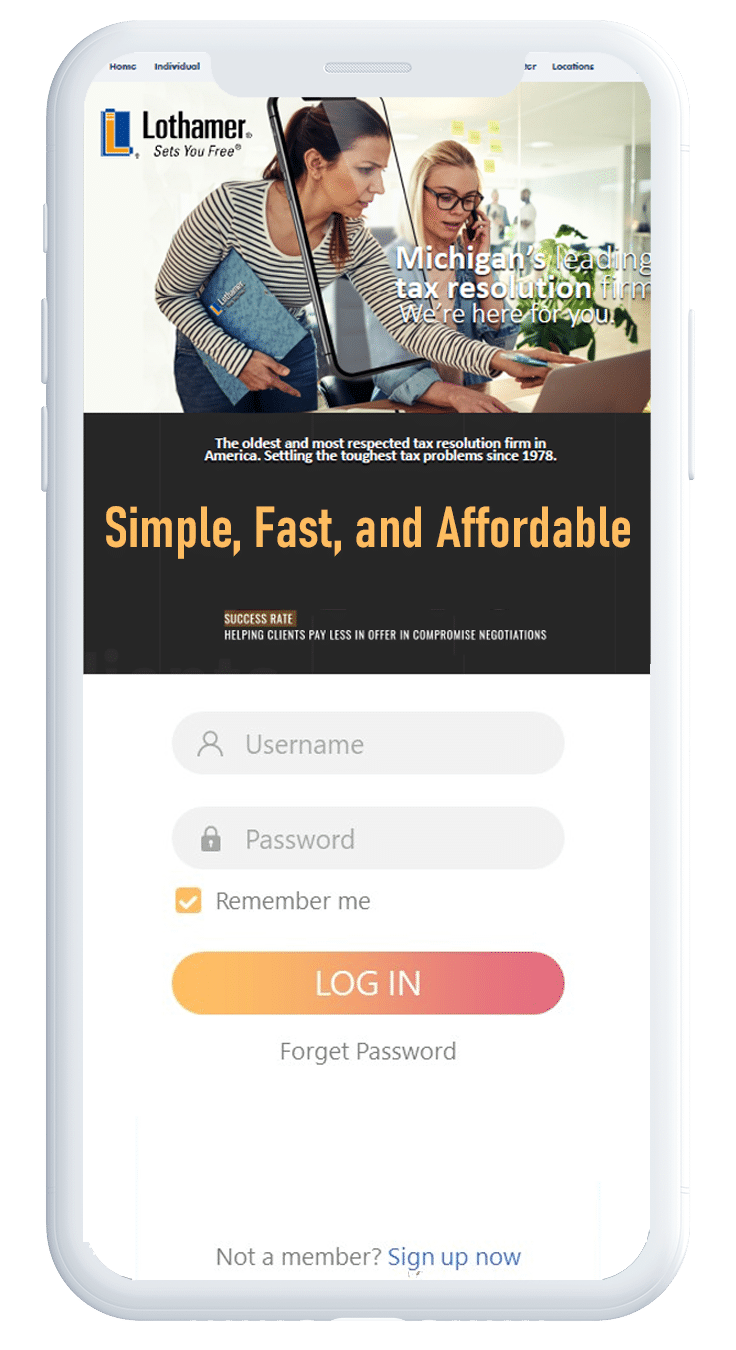

The percentage of accepted Offer In Compromise (OIC) in 2019 was 33%, Lothamer Offer in Compromise acceptance rate is over 98%. See our results.

Our IRS Success Simulator® optimizes paths to resolution including opportunities to significantly reduce what you owe. Analyze what you qualify for and quantify the optimal path to form your Roadmap to Resolution®.

If it’s financially impossible for you to pay off your tax debt there’s a very good chance that you’re eligible for an OIC settlement for a lesser amount than what you currently owe.

The IRS and State Tax Agencies have strict guidelines to decide who qualifies for an Offer in Compromise agreement, determined by a set of calculations based on your income, assets and allowable living expenses. Generally speaking, those who qualify for OICs are taxpayers with tax debt who are experiencing financial hardship.

Unfortunately, qualifying for an Offer in Compromise is less than half the battle. Preparing and negotiating Offer in Compromise settlements is a complicated procedure. Our 98% acceptance rate is a result of hard work, the passion of helping our clients, and the best people + technology. Clients sometimes ask “Can I do it myself?” and the analogy is that this is much like trying to represent yourself in a criminal trial—you can do it, but most people would agree that in order to get the best outcome, you should hire an attorney. The offer process can take anywhere from six months to a year to complete and Lothamer is with you every step of the way.

Typically, when a married couple goes to their CPA, accountant or hired tax preparer to do their tax returns, those returns will be prepared as Married Filing Joint.

This is typically the case due to the fact that a married couple will get a more favorable tax treatment for filing a joint return. Unfortunately, if the married couple is not careful, filing a joint return can result in dire financial consequences.

At Lothamer, our CPAs, Tax Attorneys, and Enrolled Agents discuss with you to determine the best filing status in relationship to the resolution that is recommended. Based on the type of resolution we determine the optimal filing status. Generally speaking, if a husband and wife cannot fully pay the balances due at time of filing, then Married Filing Separate should be examined.

A Married Filing Separate return can be amended to Married Filing Joint, within certain time limits, but a Married Filing Joint return can never be amended to a Married Filing Separate status.

Reduce tax debt with IRS penalty abatement. The tax penalties imposed by the IRS are intended to persuade taxpayers to file and pay taxes on time.

If you have had a serious circumstance (reasonable cause) in your life that kept you from filing or paying your taxes when due, you may be eligible for Penalty Abatement to reduce your overall balance due.

Let us help compose a request for Penalty Abatement detailing the events that were going on in your life at the time penalties were accumulated and ask for abatement based on reasonable cause. It is another option available to reduce what you owe when you do not qualify for another form of resolution to reduce the balance due.

The IRS Tax Statute of Limitations works two ways: it imposes a time limit on how long the IRS can collect taxes owed, and puts a limit on how long a taxpayer has to claim a tax refund.

The Collection Statute End Date (or CSED) for the IRS to collect taxes owed is 10 years from the date the tax was assessed, not when the tax was due. For example, if you file a return late, the statute starts from the time the return was filed. Certain factors, such as filing Bankruptcy or an Offer in Compromise (OIC), extend the Statute of Limitations

We can advise you of the CSED for a tax period and offer a resolution to stop enforcement activity until the CSED for the tax period expires.

If you are owed a refund, you have three years from the date the return was due, or two years from when the tax was overpaid, to file and claim the refund. If you don’t act within the statute, the refund is gone forever—there are no exceptions! Every year millions of dollars are lost to expired refunds.

Most national tax resolution firms attempt to steer all clients away from bankruptcy simply because they do not offer that service. They do not look at Bankruptcy as a potential option even though declaring bankruptcy puts an automatic stay on delinquent taxes, but there are many considerations. We analyze ALL your options to offer you a comprehensive plan that will make the most financial sense for you.

When a person has a back tax issue, there are many different paths towards resolution. One option may be filing a Chapter 7 or Chapter 13 Bankruptcy. Bankruptcy can be an effective way to put your financial house in order and potentially reduce the total tax liability owed.

In a Bankruptcy, there is a distinction between priority and non-priority debt. With regards to Income Taxes owed, priority debt survives while non-priority debt gets discharged. Priority debt is generally your most recent three tax years owed, while anything older is generally considered non-priority. Any unpaid balances of the non-priority debt will be fully discharged upon completion of the Bankruptcy. Clients have been able to go through a Bankruptcy and come out with a totally clean slate with the IRS, effectively paying “pennies on the dollar” for their tax bill, while eliminating other unsecured non-tax debt.

All interest and penalties cease to accrue during the Bankruptcy period, allowing you to keep the debt from spiraling out of control. A Bankruptcy places an automatic stay on collection activities. Any previously issued levies will be released and no new ones can be issued while the Bankruptcy stay is in place. A Chapter 13 Bankruptcy may allow for a more favorable payment plan than the taxing authority would. Through a Chapter 7 Bankruptcy, you may be able to discharge tax debt and/or consumer debt, putting you in a better financial situation to resolve any remaining tax liabilities if they are not all fully discharged.